child tax credit september 2021 date

September 16 2021 735 AM MoneyWatch. IR-2021-153 July 15 2021.

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Wait 10 working days from the payment date to contact us.

. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300.

September 14 2021 1235 PM CBS Chicago CBS Detroit -- The third round of Child Tax Credit payments from. The Internal Revenue Service IRS sent out the third round advance Child Tax Credit payments on September 15. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. What time the check arrives depends on the payment. Or December 31 at 1159 pm if your child was born in the US.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. Max refund is guaranteed and 100 accurate.

Taxpayers and 2 allows such residents with one or two children to claim the refundable portion of the credit on the same basis as residents with. This bill 1 allows residents of Puerto Rico to claim the refundable portion of the child tax credit on the same basis as US. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

3600 for children ages 5 and under at the end of 2021. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for. Property tax rebates for homeowners earning less than 250000 -- or 500000 if filing.

Child Tax Credit. For each qualifying child age 5 and younger up to 1800 half the total. For each qualifying child age 5 and younger up to 1800 half the total.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. When Will Your September Payment Arrive. In 2021 then you will receive the child tax credit.

3000 for children ages 6. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Four payments have been sent so far.

It doesnt matter if they were born on January 1 at 1201 am. IR-2021-218 November 9 2021. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. September Advance Child Tax Credit. That means the total advance payment of 4800 9600 x 50.

WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance. Introduced in House 01042021 Child Tax Credit Equity for Puerto Rico Act of 2019. October 5 2022 Havent received your payment.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

A permanent expansion of the earned income credit from 18 to 20 of the federal credit. Free means free and IRS e-file is included. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of cash to millions of families. All payment dates.

Tax Worksheets Tax Deductible Expense Log Tax Deductions Etsy Printable Planner Happy Planner Finance Planner

2021 Child Tax Credit Advanced Payment Option Tas

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Will There Be Another Check In April 2022 Marca

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Benefits Of Bookkeeping Bookkeeping Accounting Fiscal Year

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Dates As Irs Set To Send Out New Payments

Daily Banking Awareness 13 14 And 15 October 2020 Banking Awareness Financial

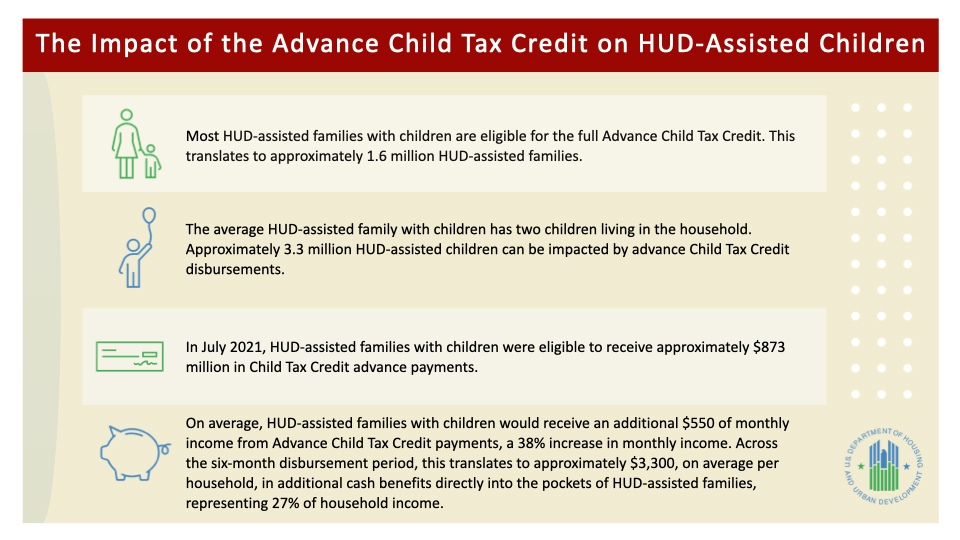

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back